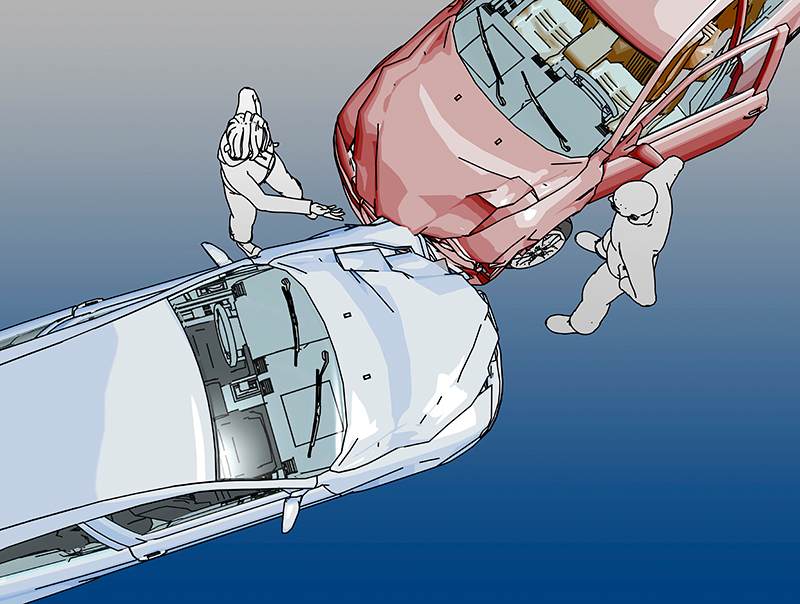

Plans to reform whiplash claims will marginalise victims, says Theo Richardson-Gool

Later this year, the Ministry of Justice (MoJ) is likely to come to a decision over its plans to increase the small claims threshold from £1,000 to £5,000, for victims of road traffic accidents. The government has made a commitment to tackle fraudulent whiplash claims and reduce consequent legal costs. More recently, there has been speculation that this limit could be raised as high as £15,000 for all personal injury claims.

By raising the claims threshold, the government believes most whiplash claims will go through the small claims court, and thus prevent rising insurance premiums and reduce costs for defendants (often insurers) when challenging fraudulent whiplash claims. The impetus is for personal injury victims to either represent themselves or bear the costs of legal representation, as opposed to insurers paying for such costs under the current rules.

The MoJ has been spurred on by estimates from insurers that whiplash claims add £90 a year to the average motor insurance policy, although

.tmb-mov69x69.jpg?sfvrsn=961ae4db_1)

95ca96e3d47f4eff8d147c4f0df17c77.tmb-mov69x69.png?sfvrsn=3db5d86b_1)