Peter Vaines on strict liability criminal offences from Mars, punitive penalties & disguised salaries

HMRC has published a guidance note entitled No Safe Havens 2014. It has caused a lot of trouble. However, the substantive document looks wholly uncontroversial—indeed it seems to be an excellent summary of how HMRC gains access to information on offshore accounts, making it pretty clear that if you have an offshore account, they will find it—and when they do, there will be serious consequences with penalties up to 200% of the tax evaded.

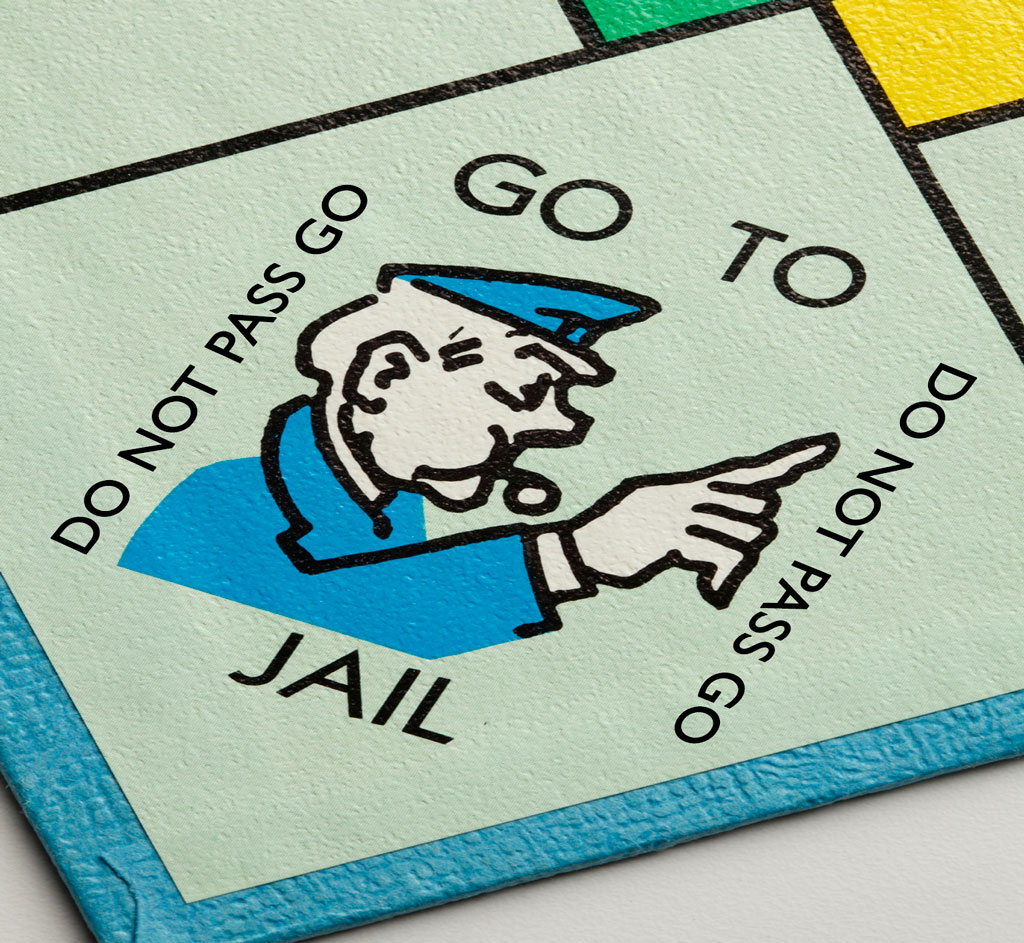

Of course, there should be criminal penalties for people who evade taxes; that is a crime and should be appropriately punished. So why has it caused trouble? It is because in the foreword there is a sentence which says that the government will introduce a new strict liability criminal offence that could mean jail for those who do not declare taxable offshore income.

The two offending words are “strict liability” so that you are guilty even if there was no intention to commit