Innovation

It’s a really exciting time for legal tech. Innovation is being realised across several areas, much of which is being driven by customer expectations. For example, people have been able to apply for, setup and have immediate access to their bank accounts on their phones, yet there has remained a need for legal documents to be physically signed. The pandemic however has accelerated the adoption of remote signing—speeding up legal processes and even making it cheaper for the parties involved. It’s clear that remote working has forced the sector to adapt and, in some instances, has been able to turn this into opportunities to work more efficiently.

Back to basics

A lot of challenges faced by legal professionals come back to basics. The probate process is complex and unfortunately is built upon many years of cumulative changes. This means that there is significant duplication of data required across multiple documents and forms. The data entry and reconciliation alone take a notable amount of time and can be prone to human error. By adopting technology, such as Exizent’s platform, law firms are given more time to focus on the real value-add portions of the process, rather than spend laborious hours on data entry and reconciliation.

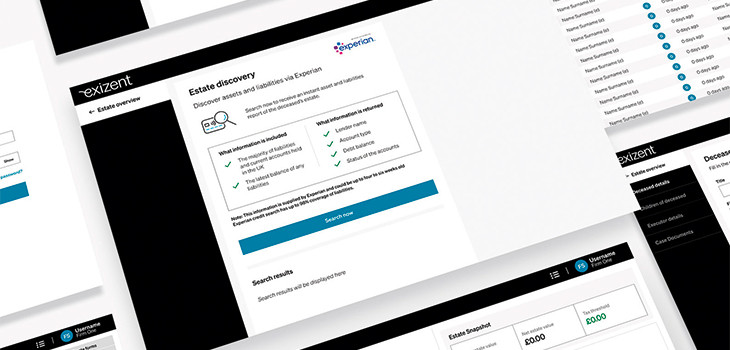

Another major headache across the industry has been sourcing data. As the world becomes more digital, identifying items that belong to a person’s estate like bank accounts, insurance policies and even cryptocurrency, becomes more difficult as we no longer retain easily accessible physical records. This is where features such as our Estate discovery come into play to develop a digital picture of individuals and reduce the time taken to identify estate items.

Direct access & Estate discovery

Probate professionals can now access Experian data directly within Exizent’s platform through a report and discover a deceased’s key banking assets and financial liabilities in seconds—a process that can take solicitors many weeks to complete. We see Estate discovery being used in two ways for probate cases:

- the identification of estate items at the beginning of a case, reducing research time and providing a checklist for those dealing with the case;

- the validation/due diligence towards the end of a case to ensure no estate items have been missed.

It’s clear that technology is pushing a number of benefits within the sector’s workload and customer experience, however the use of technology still raises questions about the safety and security of business and client data. Data security should be at the core of any technology discussion though we still see too many articles discussing data breaches, data loss and hacked systems from companies not paying it the attention it deserves.

As an industry based on privileged data, significant effort goes into securing data, using standard approaches, and sharing knowledge and information as and when vulnerabilities are discovered. As with any modern engineering business all of our code is scanned for exposures at the time of any change and our environments are regularly tested against industry standards—giving clients and their customers the peace of mind they need.

A better future

As we have seen in the financial sector, major initiatives such as Open Banking and Open Finance have driven standardisation which in turn opens up opportunities. Legal firms continue to embrace technology and with it I expect we will see an increasing number of data standardisation, that will drive interoperability of services and enable platforms, such as Exizent’s, to provide data aggregation supported by trusted and secure Digital Identity. By combining this with the power of AI and Machine Learning we can truly free up those working in legal firms to spend more time helping people, rather than completing paperwork. However, we have a way to go in terms of legislation, particularly around identity and how we securely allow delegated access to the accounts of the deceased.

.tmb-mov69x69.jpg?sfvrsn=961ae4db_1)

95ca96e3d47f4eff8d147c4f0df17c77.tmb-mov69x69.png?sfvrsn=3db5d86b_1)